, made a few HUD 184 fund, both for the construction of new home with the Flathead Indian Reservation inside northwestern Montana. Secretary Vp Milanna Atwood, who is the latest bank’s a residential property financing administrator, said it was not tough to personal the latest finance and that they were typical of any sort out-of government-ensure program. Atwood done these types of financing on the HUD’s Place of work out-of Indigenous American Apps, situated in Denver, and you can she discover the employees of use. Area Bank off Ronan utilized an initial-date homebuyers system supplied by this new Montana Board away from Property (MBOH) in scam, brand new customers obtained twenty five-12 months finance that have good 6 % interest. The brand new finance was indeed next offered to MBOH, and bank remaining the latest upkeep bit. Atwood mentioned that the financial institution really wants to build a lot more HUD 184 funds, noting you to definitely “This choice is beneficial since the a bank can sell brand new loans on the second field without having to keep them for the the courses.”

This new supplementary business

Because of the anomalies of fabricating mortgage loans within the Indian Nation, including loans was previously experienced unsaleable. It meant that financial try facing a couple selection: maybe not putting some financing or staying a long-identity house towards the its books. not, access to the latest second market is the answer to while making mortgages as available toward bookings because they’re regarding the remainder of the world.

HUD 184 money are ordered of the, certainly most other communities, the new Federal national mortgage association (Federal national mortgage association). Considering Ken Goosens, providers movie director having Local Western mortgage apps during the Federal national mortgage association, orders off HUD 184 money have raised during the past four ages. To your a nationwide base, Fannie mae features bought more than three hundred HUD 184 finance, dealing with 52 tribes inside 16 says. On the Ninth Government Set aside Region, Federal national mortgage association enjoys purchased from the sixty finance.

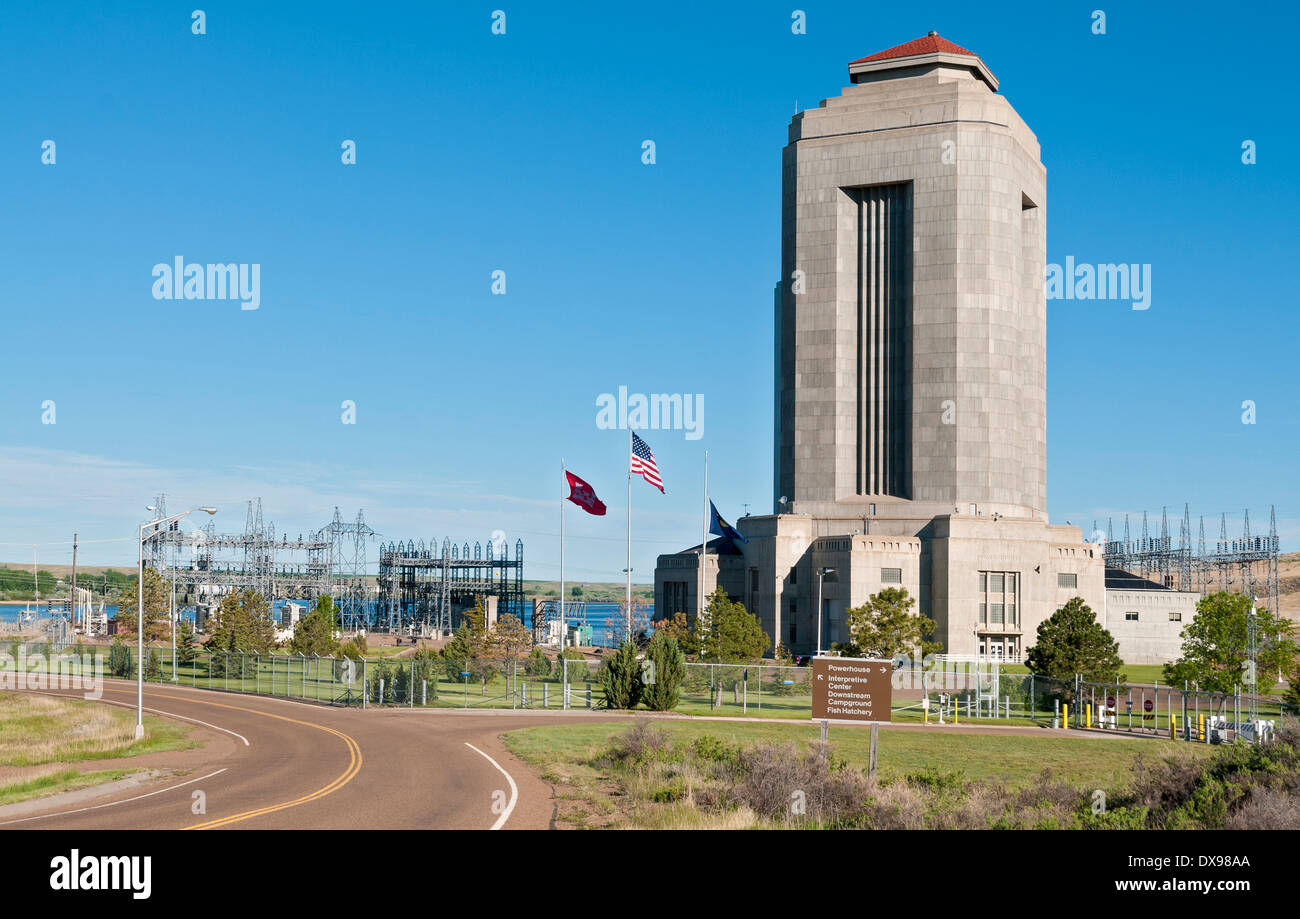

So it Nevada personal loans online attractive domestic towards Fort Berthold Indian Booking is the brand new earliest household financed through the Northern Dakota Housing Financing Agency’s HUD 184 real estate loan system partnership.

Imaginative partnerships

To help using the latest HUD 184 financing system for the the new Northern Plains, a national mortgage company and you can your state housing authority keeps per molded partnerships designed to clarify financing processing.

In one single partnership, Norwest Home loan into the Southern Dakota together with Aberdeen BIA area place of work are working to one another to cut off administrative delays one to irritate loan providers and increase the cost for each purchase.

Predicated on Jones, brand new BIA’s urban area manager, “It simply is as easy as attaching brand new title condition declaration, which consisted of the brand new courtroom malfunction, to the mortgage application. Ahead of, every legal definitions had been wrote onto the app, and mistakes took place, and this contributed to applications are repaid and you may onward between the urban area BIA office together with federal BIA place of work.” She explains, “When you deal with rural home purchases, courtroom definitions will get long and errors do occurs. On the specific judge description connected to the application, i save your self a few measures.” The process, booked to begin with once the BIA in the Washington, D.C., offers recognition, is always to dramatically decrease the time involved in approving a beneficial HUD 184 mortgage.

In another partnership, the brand new Northern Dakota Houses Loans Service (NDHFA) keeps teamed that have Federal national mortgage association and you will an area financial to attenuate the amount of operating necessary for the bank. NDHFA ‘s the earliest houses fund agency in the united kingdom to help you sign an agreement with Fannie mae allowing the brand new department to sell and you may service HUD 184 funds directly.

The key member of this-of-a-form program are Patrick Fricke, the latest agency’s manager movie director. Fricke along with his personnel acknowledged difficulty stayed regarding the beginning from affordable outlying homes, therefore, the department created a great airplane pilot system in 1992 called the Software Running Service. Having a fee, the newest company have a tendency to deal with the borrowed funds techniques constantly: underwriting, planning the borrowed funds-closing files and you can planning the loan offered into additional markets. The bank takes the original software and shuts the loan. From the working with Fannie mae, the brand new agencies serves as an effective conduit toward secondary market for quick loan providers. Fricke claims, “Lenders are in the business of fabricating customer matchmaking, and then we give reasonable property. For me which is a practical partnership.”