Furthermore, IHG You to Advantages points don’t end to own professional players https://happy-gambler.com/bohemia-casino/ on the system. Yet not, you to definitely doesn’t necessarily mean you’ll have the same worth with lodge remains. There are numerous situations where you can purchase outsized worth by to purchase points then redeeming him or her, thus assist’s enter you to definitely inside a little more outline.

Purchase IHG You to Benefits points away from 0.5 dollars for each and every as a result of Oct. 9, 2023

Such as, you could guide an overwater property at the Six Senses Laamu Maldives for 100,one hundred thousand IHG points a night (having a fourth nights free your’d pay just 75,100 items per night), if paid rate will be more than $1,five-hundred a night. When you’re all costs are subject to changes, allow me to offer some situations of some money saving deals I’meters seeing now playing with IHG You to Benefits points. Once more, remember that IHG issues would be obtained to own 0.5 dollars for each using this type of strategy. People have a tendency to worth things in a different way, but personally I value IHG You to definitely Perks points at the ~0.5 cents for each and every, and i usually value issues very conservatively. All the information for the Hilton Amex Searching could have been gathered separately by the Items Kid. On top of that, Hilton professional participants will get a fifth evening free to your honor stays.

bet365 Bonus Password POSTNEWS: Bring $1K wager insurance otherwise $two hundred inside extra wagers to own college or university sporting events, the sunday sports

The brand new sign up extra try a good cheer after i transferred a good bit to begin with trade – provides me a little extra bucks to work with when i know the brand new ropes. The new 100% added bonus invited me to try various other tips and also have a good getting for the platform instead risking as often of my very own money. What’s sensed “typical” or “good” to possess a bonus amount extremely utilizes the type of added bonus you’re getting. A yearly extra of 5-10% of your yearly income is actually basic in lot of marketplace, exactly as a good 5-10% annual boost is regarded as standard.

Financial, Revenue, and you can Distributional Feeling of Permanent 100 % Bonus Depreciation

Rather, they normally use Points.com (an authorized) to help you techniques section orders. Even if your purchase out of points or miles is created through the business’s web site, it won’t be eligible for one travelling classification extra given by certain handmade cards since it shows in your cards as the a purchase from Things.com. Hilton Celebrates typically fees one penny for each and every bought part, in addition to all taxation and fees. For many who’re eligible for the a hundred% extra and you may maxed out of the give, you’d receive a total of 480,100 points at a price away from $2,eight hundred, which is a speed away from 0.5 cents per Hilton Celebrates point.

Audit & accounting

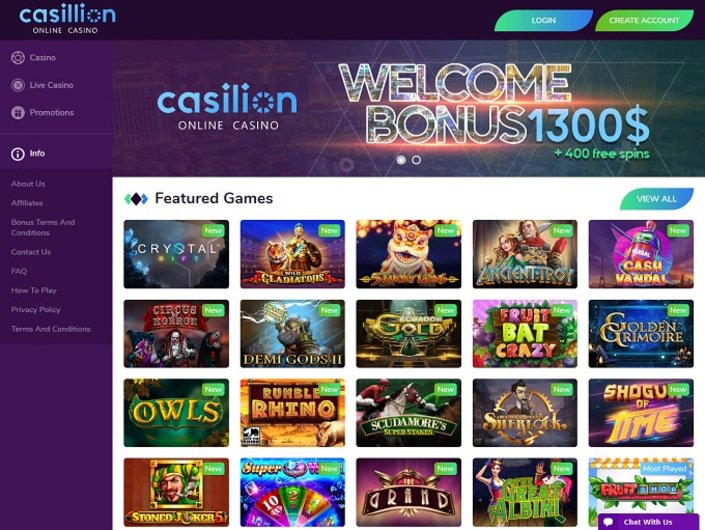

All of our gambling enterprise benefits has a lengthy records having casinos on the internet and you will the bonuses and rehearse that it experience in their reviews. Sure, there are numerous kind of on-line casino greeting bonuses for your requirements to pick from. In fact, you might want to start out with one thing less risky, such as a no deposit added bonus. Even though gambling enterprise incentives can enhance your own gambling experience significantly, you should know away from well-known issues to quit. Inside point, we’ll talk about the dangers of ignoring terms and conditions, overextending your money, and you will failing woefully to fool around with bonus rules. Abreast of objectively watching a great one hundred% put match incentive, we can identify many perks and downsides.

But not, Part 179 and you may bonus (and you can regular) decline are only designed for business property you listed in solution inside income tax season. House is “listed in provider” if it is ready and you will available for its tasked setting on your own team. As long as it is available for for example have fun with, it’s not necessary to in reality use the assets for organization through the the year for taking decline.

7024, the Income tax Recovery for Western Family and Specialists Act out of 2024, which has a hundred% extra depreciation, as well as lookup and you will development expensing and you will a development of one’s Kid Income tax Credit. He or she is an excellent sale equipment to own casinos on the actually-broadening gaming industry. The crowd is hard and you will the fresh incentives are created the time for you to contain the online game to the.

Exactly what Bank card Should you decide Used to Purchase Items and you can Kilometers?

Let’s consider a few times when purchasing Hilton things will save you big money versus paying the cash price. FXCC brand name are a worldwide brand which is joined and you can managed in various jurisdictions which can be dedicated to providing you with an educated you are able to trade sense. Unfortuitously Aeroplan could have been experiencing difficulity with many companion honours, in particular to own travel to your Etihad Airways. Thus unfortunately currently those people redemptions mainly aren’t it is possible to.

What other implies do you earn Aeroplan things?

There’s no hobby required to keep the membership usage balance alive, but alternatively you can keep your miles regardless of the. People often well worth distance currencies in different ways, but individually We worth United MileagePlus miles in the ~1.1 cents for every. I usually well worth issues very conservatively, there are many how to get more worthiness of MileagePlus kilometers than one to. People usually really worth items in different ways, however, personally I really worth Hilton Honors things at the 0.5 dollars for each, and i tend to worth points fairly conservatively.

Cards

Including, a great taxpayer could possibly get basic apply compliance to financial statement expensing, where you can, using the de minimis legislation. Following, use incentive decline and you can section 179 to possess issues ineligible beneath the de minimis laws, considering particular qualifications and you can stage-away thresholds to maximize the fresh tax work for. For both someone and firms, taxable income is different from—which is lower than—gross income. Since the incentive depreciation phases over to the following years, certain small enterprises could possibly take care of some 1st-12 months expensing playing with Internal Money Code Point 179 laws and regulations.