Fundamentally, always make sure to adopt things comprises the latest origination commission. Certain lenders plan other charges, such as for example app and you will operating charge, involved with it. In the event that’s the scenario, ask to possess the individuals bundled charges waived.

How to Pay Mortgage Origination Fees

Origination costs will get depict only a tiny the main closure can cost you and you will charges that must definitely be paid when getting into an excellent mortgage. Particular so you can a home loan, there is certainly a variety of an approach to spend so it small pricing. Remember that the ways to cover the origination fees here are not sick or placed in people version of buy.

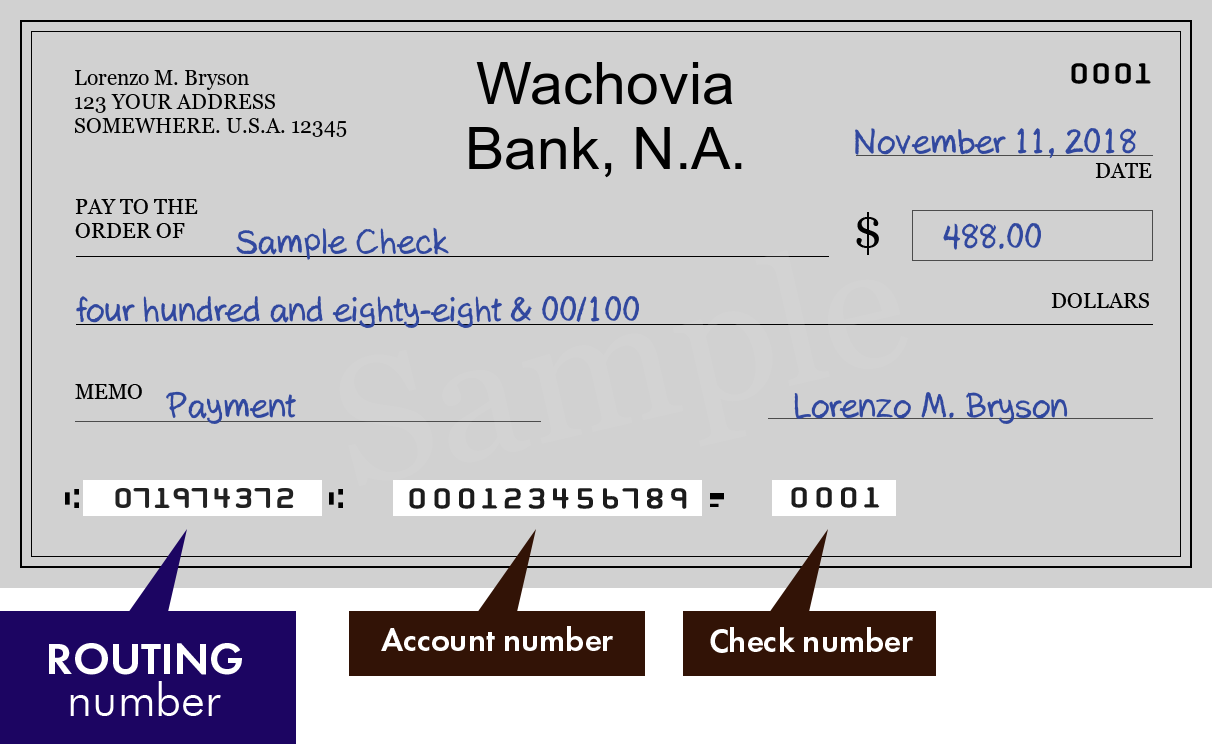

- Initial payment: Borrowers can pick to pay the mortgage origination costs upfront at the the full time from closing. This requires creating a otherwise making an electronic percentage so you can the lender to pay for charge in full.

- Going on the mortgage: A different popular approach, consumers have the possibility to provide the loan origination charges on full loan amount. So it increases the prominent amount borrowed. In that way, the debtor is also spread out the cost along side longevity of the borrowed funds, it might increase the full loan amount and, after that, the fresh month-to-month mortgage repayments; an example of this is revealed less than.

- Seller contributions: In many cases, owner of the property could possibly get commit to lead a percentage otherwise all loan origination costs within the negotiation procedure. This can be called a great seller’s concession and certainly will lessen brand new borrower’s out-of-wallet expenses on closure.

- Bank credit: Some loan providers can offer bank credits since a reward so you’re able to individuals. Such credit enforce toward since the financing origination fees and other settlement costs. However, lenders providing loans may commonly costs a slightly higher interest rate in return for these experts. While doing so, the new credit might have gone toward almost every other will cost you, therefore keep in mind that it indicates this new origination charge just weren’t always waived.

- Creator or creator incentives: In case the loan is for a special structure domestic otherwise a beneficial possessions being created by a creator, the builder or designer may offer bonuses to pay for a percentage of one’s financing origination charges to attract customers.

- Closing costs guidelines software: According to borrower’s financial situation and location, it . These types of applications may offer gives, low-desire financing, or other different financial aid to greatly help shelter loan origination charge or other closing costs.

- Discussing to the lender: Borrowers can also be make an effort to negotiate into financial to minimize or waive some of the financing origination charge. This can encompass shopping around to own several loan providers and using fighting also offers just like the power throughout transactions. Keep in mind that in competitive surroundings, it could be difficult to feel the entire origination payment waived.

Mortgage Origination Charges vs. Situations

They show different aspects of your financing process. Consumers will come across the both as part of the buy and you will money data.

Things are upfront charges repaid towards the bank during the time out of closing the borrowed funds indicated once the a percentage of the full loan amount. There’s two brand of points: discount activities and origination affairs. Disregard points try recommended fees consumers pays to attenuate the new interest on financing. Origination points was costs energized by bank to have control this new loan application and performing the americash loans Hackleburg locations borrowed funds, fundamentally compensating they because of its characteristics.

Loan origination charges are different. They are particular costs implemented from the bank having handling the application for the loan and you will facilitating the loan processes. Loan origination fees may be a flat fee, usually expressed from inside the dollars, rather than a percentage of the loan amount. These charges should shelter administrative will set you back, documents, and other properties employed in researching this new borrower’s creditworthiness.